How do you follow up the Henley-on-Thames Regatta? Well, in London, far too easily. Took the family for an enjoyable afternoon at the Royal Albert Docks watching the Dragon Boat Regatta the following day.

Simply Messing About In Boats…

On Saturday, 29 June, the Chairman of the Broad Street Ward Club, our Common Councilman Chris Hayward, and the Secretary, Judith Rich, organised the most delightful day in Henley-on-Thames. Saturday was the day before the Regatta, so the town and the teams were polishing and practising everywhere. The day started with a whirlwind tour of the River & Rowing Museum. This architecturally stunning museum combines several themes – rowing, the Thames, local Henley history, and The Wind In The Willows. Then some of us took to the water for an hour to inspect the course. In a spirit of gamesmanship, we used a stinkpot rather than a scull to give the crews a fighting chance. Lunch is always a highlight of a Broad Street Ward Club day out, but in this case our Chairman used his connections as a member of the renowned Leander Rowing Club to have us dine above the river and amidst the pink hippos.

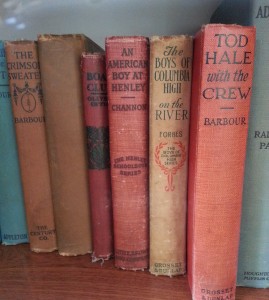

Following lunch we were permitted to view the Leander Club library where a delightful surprise emerged. The library had been founded with a donation of 1,750 books from Tom Hoffman, also a Common Councilman and Gresham College Trustee. I’d never known… And I had to take this picture of An American Boy At Henley.

Tickets to the museum are good for a year, so we returned after lunch for a second dose before catching the train home. As Rat (Kenneth Grahame) solemnly observed, “there is NOTHING — absolute nothing — half so much worth doing as simply messing about in boats.”

Halloween – Banking Technology Awards

It’s important to celebrate the contribution of numerous businesses towards making London the world’s leading global financial centre. I’m pleased that David Bannister continues to run his Banking Technology Awards and it’s always educational to judge them. So, on Halloween this year, Thursday, 31 October, it’ll be a scary night for some…

Why Broad Street?

A number of people have asked about Broad Street Ward and what’s interesting about it. I’ve started a page from which people can take links to various items – http://www.mainelli.org/?page_id=235

You probably have suggestions. All welcome!

Battle of the Quants

Working with Bartt Kellermann and Selvie Shaqiri to help bring their very successful US format here to the UK. Very interesting session today discussing this brief title – “ From the Ephemeral Quant to the Eternal Coin: Short Term vs. Long Term Considerations when Allocating to Quantitative Based Strategies”. Thankfully, some of our thoughts on Long Finance really rang a bell, and folks seemed to be interested in Asymmettric Gain-Loss Recognition, Performance Policy Bonds, Confidence Accounting, Irreversible Time, Unburnable Carbon, Internal Growth Rate as a key regulatory pension metric, and Volatility = Sustainability. Wow. Great crowd.

Election of Sheriffs

I attended the annual election of two Sheriffs for the City of London today. Alderman Sir Paul Judge (Ward of Tower) and Robert Adrian Waddingham CBE were elected by acclamation.

The new Sheriffs will be admitted into office on Friday 27 September ready to preside at the Election of the Lord Mayor on Monday 30 September. They will hold the position for one year.

The office of Sheriff, a pre-requisite to becoming Lord Mayor, is one of the oldest in existence and dates back to the Middle Ages. Their duties today include attending the Lord Mayor in carrying out his official duties, attending the sessions at the Central Criminal Court in the Old Bailey and presenting petitions from the City to Parliament at the Bar at the House of Commons.

If only it were so easy in Broad Street Ward (sigh), but a great ceremony at the Guildhall.

Battle of the Quants

Working hard to get elected and already finding that the number of speaking engagements is climbing sharply. I’m speaking next week at Battle of the Quants. This is a very popular New York event format which is coming to London a second time. I’ve been given a succinct title – ” From the Ephemeral Quant to the Eternal Coin: Short Term vs. Long Term Considerations when Allocating to Quantitative Based Strategies”. We’ll see how well this audience takes to Long Finance‘s thoughts on the long term.

Last Post

No, probably not the last blog note, just pointing out that yesterday, Wednesday 19 June, was the last opportunity for a postal vote application. Voters are now committed either to come in person or a postal ballot. On our side, we managed to get everyone in the ward either by post or hand (mostly hand!) a flyer and a postal application form by yesterday afternoon.

Meanwhile, it was also the last post for me at 22:20 last night. I was presenting, with Dr Iain Saville, the Systems in the City Awards 2013. Iain was on first and got the individual awards out of the way. Then a ventriloquist came up – Nina Conti. She’s possibly the funniest ventriloquist I’ve ever seen (and I’ve actually seen a few, including one last year in Germany the family booked). Her act featured a mind-bending routine with a monkey. Then, when the audience was well ready (ahem), up I pop for the corporate awards. Was I the organ grinder? While I may have drastically shortened my speech about yesterday’s Parliamentary Banking Commission on Banking Standards report, “Changing Banking for Good“, and Long Finance, the audience strangely didn’t seem to notice the cuts. A good time was had by all, and there are some very proud winners this morning.

Son of Canvassing Concerns – Kiss The Girls And Make Them Wry

Another day of meeting electors round the Ward. What a fascinating Ward we have! Two more areas of concern which may help folks get a flavour of voter issues on the street:

- signage in Austin Friars, a cul-de-sac, could use some work, particularly helping to promote the Dutch Church;

- with increased partying in the City, much of it welcome to local tradespeople, how can we find subtle, yet effective, ways of ensuring that Thursday and Friday night rubbish doesn’t interfere with the next morning’s business.

I’m building up quite a list of things to do at a local level. Future posts will start to shape some of the international issues. Meanwhile, for those who wanted a better picture of Uma, certainly not me, there was a lovely resolution to our previous post. She got a “wugga wugga” (don’t even ask, but she likes them) and I got my campaign ‘baby kiss’ out of the way – though the poor dear may have nightmares for a few days about the “errgyly monster what Mummy save me from”.

PS – You can see she’s saying “Broad Street Ward needs you!” [well, in German]

Canvassing Concerns – Kiss The Girls And Make Them Cry

Canvassing is a great way to ensure you do remain educated and in touch with voters’ real issues. Today the two big concerns, repeated by several, were basically:

- begging – not ‘anti’ beggars, but wanting to find a solution that reduced the hassle factor for shops and smokers, as well as reducing opportunistic thefts – I was struck by the realistic attitudes taken by Ward electors on this issue;

- enforcement of traffic regulations – and a particular issue with portable ‘shredding’ factories sitting on footpaths churning loudly away and ignoring traffic rules and fines – this is something local to me about which I must find out more.

There was significant praise, for the most part, of the City of London Police and their responsiveness to situations which can only be, at best, partly resolved. More to learn during the week!

And in breaking news, my long-standing sailing friend Uli gives me her lovely 18 month old daughter, Uma, to kiss in order to supply the obligatory ‘baby kissing’ shot – but Uma proves too fast, or too wise! Yet, there is a happy ending…