It was simply fantastic to have 230 friends and supporters turn up at the Dutch Church at noon on 19 September for the traditional “Shrieval Chain Presentation”.

Continue readingNothing To Lose But Our Chains… (Badge, and Brooch)

Banker Baron Overstone, on seeing the “unmitigated disappointment” of his new Overstone Hall in Northampthonshire (now derelict), grumbled, “We have fallen into the hands of an architect, in whom incapacity is his smallest fault.”

Well, I certainly don’t feel as morose as Baron Overton. In the case of my Shrieval chain and badge, as well as Elisabeth’s brooch, all we can say is that we fell into the hands of a silversmith, in whom genius is his smallest fault. We are so delighted with Grant Macdonald’s work.

The Shrieval Chain and Badge of Office

presented to Alderman Professor and Sheriff-Elect Michael Mainelli on 19 September 2019 containing his coat of arms:

Continue readingEel-evated

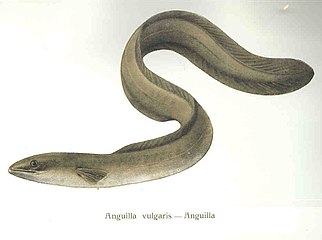

Despite being three months away from assuming office, our services were called upon within days to assist the current Sheriffs in an unusually fishy matter.

When attending a service in the Dutch Church to commemorate the Dutch eel trade, like you do, Elisabeth and I encountered a delegation from the Frisian Islands. They came on the good ship eel barge Korneliske Ykes II, with greetings and gifts from the mayor of Súdwest-Fryslân to our Lord Mayor…

Continue readingMaking Risk Normal

Sheriffs Elect!

On 24 June at Common Hall Chris Hayward CC and I were delighted to be elected Sheriffs to take effect at our installation on 27 September. Here we are pictured outside Cutlers’ Hall with our wives Alex and Elisabeth as we toured nine livery companies in ninety minutes to thank the nearly 1,400 people who turned up to vote!

The City of London Corporation Press Release provides more detail.

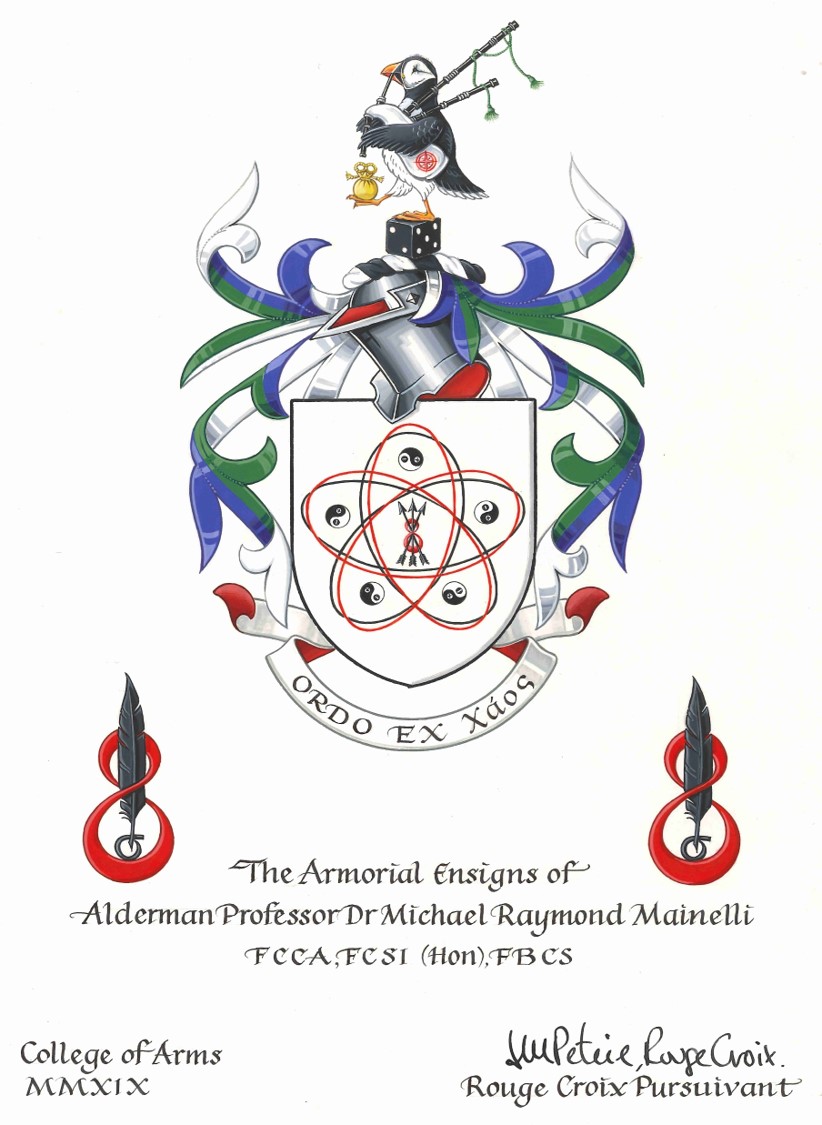

Continue readingThe Mainelli Coat of Arms

Did you ever hanker after a coat of arms? Well, in preparation for the role of Sheriff, one arrived today from the College of Arms:

Gresham’s Law – The Full Mounte-Bank

With our promotion of Dr John Guy’s excellent biography, “Gresham’s Law: The Life & World Of Queen Elizabeth I’s Banker“, we get flak from time to time for saying that Gresham’s Law is best expressed as “good money drives out bad”.

Continue readingOur Serial Friend

Toast To The Immortal Memory Of Charles Dickens (7 February 1812 – 9 June 1870)

Alderman Professor Michael Mainelli

Remarks to the City Pickwick Club at the George & Vulture, London, 25 March 2019

Continue readingNew Sheriff In Town? It Would Be An Honour.

I am pleased to announce that I received notification on Friday, 15 March, that my nomination for the Election of Sheriffs at Common Hall at Guildhall, Monday 24 June 2019 has been checked. It is all in order and I am a validly nominated candidate.

Thus, today, 17 March 2019, I open my campaign to be Aldermanic Sheriff for 2019/2020.

Declaring My Candidature For Sheriff Of The City Of London 2019/2020 –

17 March 2019

Election of Sheriffs for the City of London – Monday, 24th June 2019

Candidature of Alderman Professor Michael Mainelli FCCA Chartered FCSI(Hon) FBCS

To the Liverymen of the City of London

My Lords, Ladies and Gentlemen,

Common Hall

With a sense of honour and enthusiasm, I offer myself to the Livery for election at Common Hall to be held at Guildhall on Monday, 24th June, at 12 noon. My colleagues on the Court of Aldermen support my candicacy, as they did last year, as their candidate for the ancient office of Sheriff of the City of London for 2019/20. If a poll is demanded, I would like to ask for your support by voting in my favour at the ballot on Monday, 8th July 2019, also at Guildhall.

Continue reading