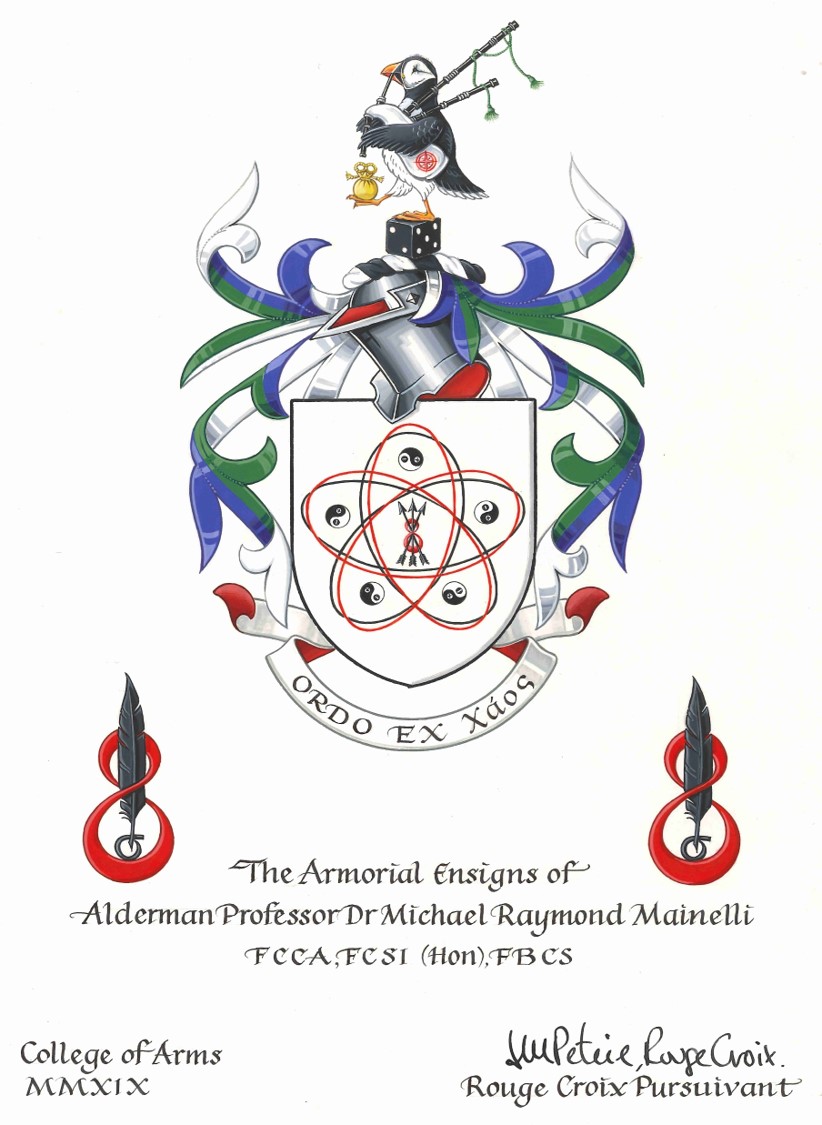

The big day, Friday, 27 September, finally arrived. Chris Hayward CC and I were sworn in as Sheriffs of the City of London. Here we are just coming out of Guildhall together after swearing our oaths and on our way to the traditional sumptuous Break-fast.

We now have a formal job description. Links if you want to follow the story so far, and as it unfolds;

Continue reading