“It’s not all banking and dealmaking, charity’s big business in the Square Mile too” – City AM

One of the earliest highlights of being Lord Mayor was hosting the President of South Korea at our State Banquet on 21 November. Imagine my delight when a week later we received two generous boxes of kimchi, some 30 packages.

It turns out that our City community enfolds many kimchi devotees like myself. With alacrity, they were all gone within ten days! Now on to mustard from the French president…

Our last livery function of 2023 was an evening with the Worshipful Company of Fan Makers. As ever, enormous fun, but you might feel this photo needs a caption:

Continue readingIt was great to award The Chartered Institute for Securities & Investment (CISI) Certificate in Ethical Artificial Intelligence to our first student, Philip Chamberlain. Philip works in Saudi Arabia but flew to Dubai where we were attending COP 28 to receive the award in person. Rapid development of Al technology means that ethical considerations must be taken into account from the beginning of the design process. Over 1000 students and 125 businesses have signed up so far to understand the ethical and management issues in the deployment of AI. Easy to sign up for the course www.cisi.org.ai.

Yes, a misspelling, should just be mangroves, but got up quite early at a man-ly hour and found myself kayaking in the Abu Dhabi mangroves around 05:30 in the morning.

Continue reading

Today we held the fourteenth annual Lord Mayor’s Gresham Lecture given by The Rt Hon The Lord Mayor of the City of London and attended by 500 people. Back in 2009, I created the idea of the Lord Mayor’s Gresham Lecture, first given by Nick Anstee in 2010, based on a simple idea: the President of an academic institution should provide an annual academic lecture. I was thrilled to be giving it myself for a change, for many reasons, including:

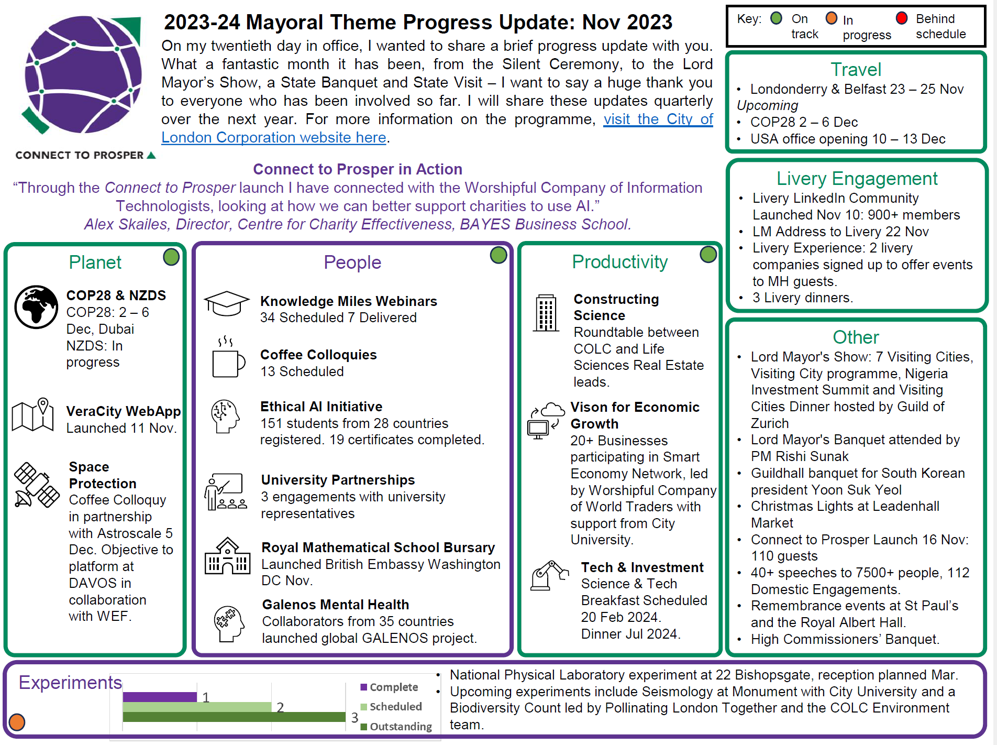

My aim was to provide an academic backdrop to this year’s Connect To Prosper theme, thus it was entitled, “Connect To Prosper – The Power Of Networks”.

Cities are networked networks of connectivity and information sharing. They create, often indirectly, communication, transportation, commercial, and intellectual networks. For the City of London, expanding and changing networks develop its strengths. Over 40 learned societies, 70 higher education institutions, and 130 research institutes surround the City of London, creating a network of knowledge connections among science, technology, engineering, arts, mathematics, and finance. In this lecture, I drew upon Z/Yen and my more than two decades of research into smart and financial centres worldwide.

I explained how the 2023-2024 Mayoral theme: “Connect To Prosper”, with its emphasis on multi-disciplinary networks, hopes to link forces to advance, just a bit, a few solutions to global problems. The talk was followed by a discussion with Professor Julia Black, Professor Mark Birkin and Professor Michael Batty, whom I thank most sincerely for some excellent contributions.

The Gresham College website has the full lecture.

If, like me, your preference is a print transcript with slides here.

Or watch on YouTube:

Delighted to have our own email signature – feel free to use and link to www.connect2prosper.net.