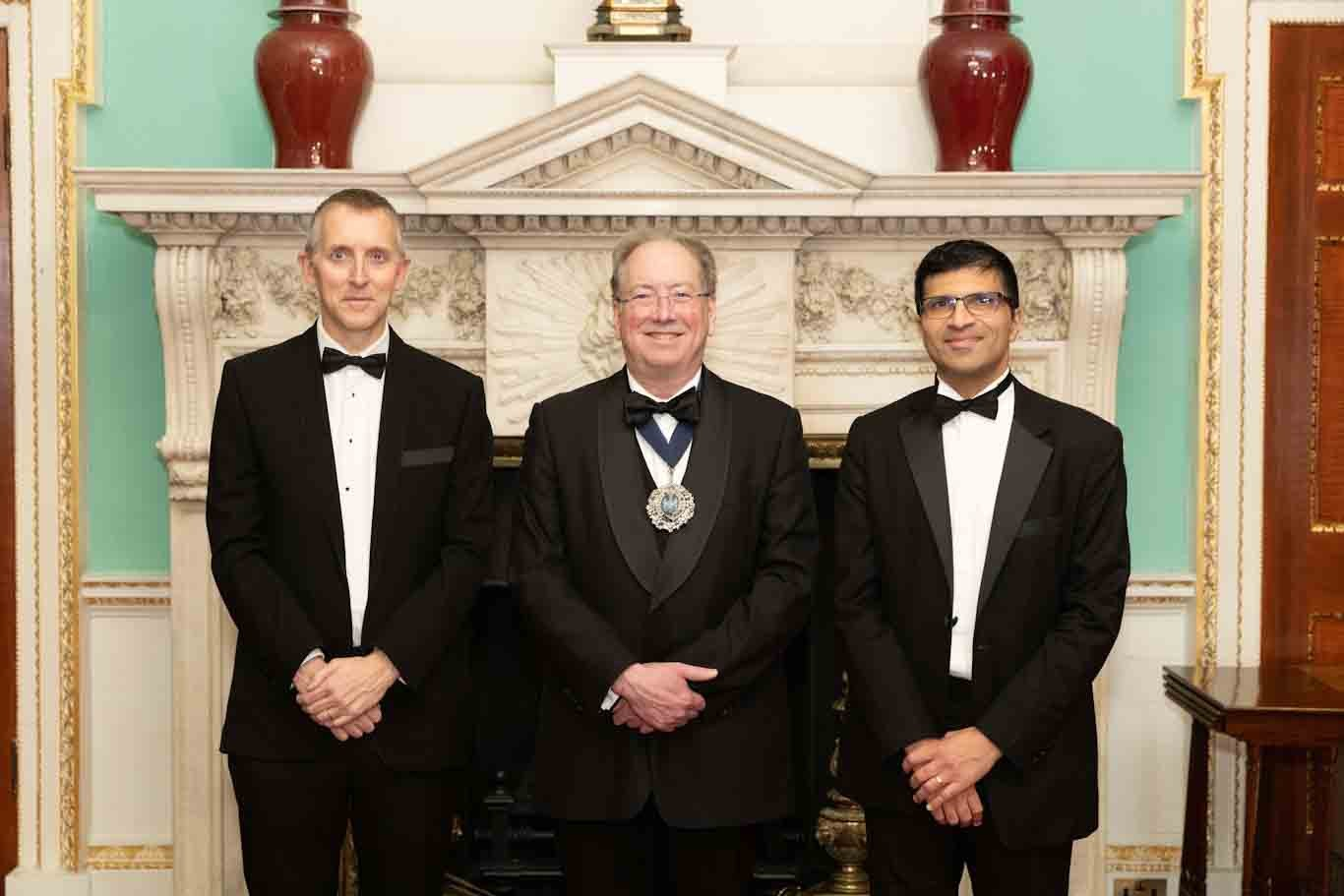

[Sam Woods, CEO, Prudential Regulation Authority (remarks); Lord Mayor (remarks below); Nikhil Rathi, CEO, Financial Conduct Authority (remarks)]

City Dinner, Egyptian Hall, Mansion House, Thursday, 17 October 2024

The Rt Hon The Lord Mayor of London Alderman Professor Michael Mainelli

Your Excellencies, My Lords, Fellow Aldermen, Mr Recorder, Sheriffs, Chief Commoner, Ladies and Gentlemen,

Good evening and a very warm welcome to Mansion House for our annual City Dinner: strange but true, a celebration of financial regulation. At such an event, first, we give huge thanks to all staff at the PRA, the FCA, and the Bank of England, for keeping our financial system safe, secure, and stable…

…and then we ply Nikhil and Sam with alcohol and make even more demands of them, to make our financial system, risk-taking, competitive, exciting…

When you consider the turnover of politicians this country has seen in recent years, Sam and Nikhil are absolute paragons of stability, which is what we like to see in the City; although we are moving towards our 696th Lord Mayor.

I heard about a regulator who asked his daughter about the work she was doing on Bitcoin. Her father asked if she would like to hear his opinion on Bitcoin, and she said yes. The father said: “It’s worthless.” “I know” she replied, “But let’s hear your opinion anyway.”

This year we congratulate the FCA on the 10th anniversary of Project innovate, which introduced regulatory sandboxes.

Our thanks today to the FCA and the Bank for your support for the Transition Finance Market Review led by Vanessa Havard-Williams and published this morning.

Expanding into the UK report

And today, the City of London Corporation also publishes a preview of a new report produced with Hogan Lovells, Expanding into the UK: a guide to regulation for global financial services firms – ahead of the full report being released next month.

Those of you desperately scanning the QR codes at your table for the drinks menu can relax now – yes you really were being re-directed to a nuts-and-bolts reference guide to the UK regulatory system.

A central theme in the report is that the UK is an open economy

where barriers to entry are low. This is in no small part thanks to our regulators, especially with their secondary objective – strongly supported by the City – of promoting international competitiveness.

Three traditional ethical liberal values are individual rights, freedom of speech, and protection of property.

To those three add three practical liberal values of limited government, free markets, and free trade.

The three practical values rely on what Adam Smith described as the most basic form of regulation: competition. Screaming Lord Sutch once asked a sublime question, “Why is there only one Monopolies Commission?”

Tackling fraud

During the two years spent by Policy Chairman Chris Hayward and me as Sheriffs of the City, our theme was strengthening & simplifying anti-money laundering, with the catchline, “if Britain is open for business try opening a bank account”.

We are delighted that in collaboration with the Financial Conduct Authority and Smart Data Foundry the Corporation helped build a synthetic dataset to support the development and testing of solutions that detect and defend against APP fraud.

Connect to Prosper

As the 695th Lord Mayor of London, I am the elected head of the world’s oldest democratic workers’ and residents’ cooperative.

The theme of this mayoralty is Connect to Prosper, celebrating the many knowledge miles of our Square Mile, the world’s coffee house.

Our 615,000 workers in finance, technology, and services are surrounded by 40 learned societies, 70 universities, and 130 research institutes, the world’s most successful and intense concentration of connected knowledge networks.

Mansion House Scholars

And in that spirit of knowledge miles the Mansion House Scholarship Scheme is a charity which educates the next generation of leaders from around the world, helping us connect to prosper. Following my recent visit to Laos, we are recruiting our first Scholar from that country.

New Scholars come from India, Uganda, China, Indonesia, and Jordan. And marking my connections, to Ireland, and for the very first time Italy. May I please ask all Mansion House Scholars to stand up and take a bow. Welcome to the City of London, and we wish you the very best in your studies.

Financial Literacy

In 1986, Ulrich Beck wrote about the ‘risk society’, “dealing with hazards and insecurities induced and introduced by modernisation itself”. His contention almost four decades ago was that citizens would continue to ask others, via government, to absorb losses while they privatised gains. How right he was.

When people hear about investment risk, they connect it with danger rather than recognising risk is also shorthand for opportunity.

We talk about the need for financial literacy, for re-adjusting the national risk propensity. That’s why we are encouraging our government to participate in the PISA Financial Literacy Assessment. We manage what we measure, and we should join 27 other nations in measuring our nation’s financial literacy, as much as we measure the three Rs.

Ethical AI

Nowhere is the tension between risk and opportunity more apparent than AI. Scientists predict human-level artificial intelligence by 2040…

Maybe sooner if the bar keeps dropping.

The 695th Lord Mayor’s Ethical AI Initiative promotes international standards, specifically ISO 42001, the AI management system, through a course, an accord, and a consensus.

A Course – taken by over 6,000 people in 600 firms across 60 countries.

The Walbrook AI Accord – leading to 38 countries agreeing to use ISO 42001 for regulation, and the formation of the AI Quality Infrastructure group.

The Coffee House Consensus – where $32 trillion of the $77 trillion of assets represented by the Corporate Governance Network have pledged their support for ISO 42001, and this very afternoon we launched a permanent Investor Council on Responsible AI (ICRAI).

A fortnight ago I had an amusing experience on a trip to Latvia, when I talked about IS0 42001 at a central bank, one of the participants said he couldn’t find any information online. I assured him the standard was online, but he insisted ‘no’. I asked him where he was searching. He said ChatGPT – so maybe generative AI isn’t so keen on ISO 42001 for itself.

On the other hand, we in the ISO sector might note we don’t provide open publication of our own standards. I am reminded of the comment by Amos Tversky “My colleagues, they study artificial intelligence; me, I study natural stupidity.”

Open Regulation

International standards are at the heart of Connect to Prosper – whether that be:

- ethical AI,

- smart economy networks,

- space debris removal insurance bonds,

- mental health,

- constructing science,

- or sustainable finance.

Standards promote excellence, they enable trade, and they foster openness.

The open movement works to address global problems through collaboration, transparency, and free access. The movement includes open data; open-source software; open design; open access, open standards … even, a bit, open banking.

May I suggest an ‘Open Regulation’ addition to the movement, with regulation that is easily accessible, readable and shareable.

An “open regulation” movement could aim to create more transparent, inclusive, and adaptable regulatory frameworks across various sectors. Here are some potential achievements:

• Increased Transparency

• Stakeholder Engagement

• Adaptive Regulations

• Innovation Encouragement

• Better Compliance

• Cross-Sector Collaboration

• Empowerment of Marginalized Voices

We can achieve this by making:

• Standards documents and guidance publicly accessible, independently timestamped, and distributed freely.

• Third parties able to obtain regulatory documents, process them into machine-readable formats, and distribute them directly and through automated tools, such as AI.

• Plain English our norm – the intended consumer of the rules is not a lawyer.

No disrespect to lawyers, but they are the only profession who could prepare a 10,000 word document and call it a “brief”.

We need to be the centre of best global practice, from wherever it hails – in open regulation, automated processes, real-time accreditation and certification. As William Gibson said: “The future is already here – it’s just not evenly distributed.”

We need open regulation for an open City. If regulation is open, then the path to responsible, reliable and resilient growth is open.

We look forward to working with all of you in delivering an open future. Thank you.