Worshipful Company of Information Technologists, 83rd Business Luncheon

“Open Commerce Drives Out Closed Commerce”

Alderman Professor Michael Mainelli FCCA FCSI FBCS

Tallow Chandlers’ Hall, 4 Dowgate Hill, London EC4R 2SH, 12 February 2014

Master, Deputy Master, Wardens, Alderman, Liverymen, distinguished Guests. I’ve had the delight of knowing this Wonderful Company for three decades. I worked at British Leyland in the early 1980’s with John Leighfield; I fondly remember scheming for reform with Alan Benjamin; like all of us, I constantly admire Dame ‘Steve’ Shirley. Back in the mid-1990’s, with the Ministry of Defence, the London Stock Exchange, and others, this Company and my firm, Z/Yen, created the Financial Laboratory Club to visualise risk.

I’ve also been coming to your business luncheons for two decades. While it’s a great honour to be given this chance to discuss whether “open commerce drives out closed commerce”, it was also a bit of a terror when your Master Michael Webster asked me to follow the magnificent Vint Cerf from three months ago. How inspiring to hear Vint’s plans for interstellar travel – truly per ardua ad astra – striving to bring mankind to the stars. My plans are more mundane. I shall swiftly star trek through community, code, and currency to ask you to promote open commerce.

Community

The writer Orson Scott Card said, “Every person is defined by the communities she belongs to.” [Speaker for the Dead, 1986]. Now the IT industry is a young community, yet there is already an old joke about three engineers, a mechanical engineer, a production engineer, and a software engineer, think Past Master Charles Hughes. The three engineers drive to the top of a steep mountain to see the view. On the way back down the car veers out of control and they barely bring it to a halt on the edge of a cliff. The mechanical engineer gets out, looks under the engine, and says, “it’s a leaking brake line. Let’s patch the hole, refill with fluid, drive home”. The production engineer says, “no, let’s try to remove the flaw from our factory floor.” The software engineer says, “hey, let’s go back to the top of the hill and see if it happens again.”

Anthropologists define a community as a group of people who are indebted to one another. At first this sounds like an accountancy definition, but in joining any community, this livery company for example, we assume debits and credits.

Code

Code is language and language is code. As a Harvard student on the internet in 1976, perhaps I should have dropped out like Bill Gates, rather than remain a penniless nerd. And I am a nerd. Though my wife may cook a blackberry tart or a mulberry cheesecake, we have two Raspberry PIs at home. I’m still the unpaid IT director for some Ubuntu Linux machines. You’ll date me easily when I say FORTRAN, COBOL, PL/I, PASCAL, or Cnot++. I love the geek cartoon XKCD where a programmer dreams of a universe coded in Lisp but God explains, “Honestly, we hacked most of it [the universe] together with PERL.” [https://xkcd.com/224/]

At Harvard at the start of the 20th century, the faculty presented President Lowell with compelling arguments for a new department of political science. President Lowell agreed but remarked, “Gentlemen, there is no such thing as political science, we shall call it Government”. And it is the Government department to this day. Computer science is at that stage – it’s really just computing. We hack it all together. Yet some theory matters.

After mathematics, the biggest theoretical effect on code was linguistics. It’s an unusual fact that in the 4th century BC the scholar Panini described Sanskrit using transformational syntax. In the 1960’s we computer folk adopted Noam Chomsky’s syntactical theory to build language compilers. FORTRAN 1 took thirty man-years in the late 50’s. Today we expect an undergraduate to build a compiler as a semester’s exercise.

When we code, we squeeze a community’s language into a machine. Over the years I’ve had to cram a parabolic missile guidance system into 4k of memory, or jam a world of Mundocart and Geodat maps into 4MB of DEC PDP storage. I once coded biorhythms, though there I won’t claim they make sense. Today my firm encodes statistical learning theory. Coding teaches us about ourselves, in a little class ditty from the 1970s [archive text provided by William Joseph]:

I really hate this damned machine,

I surely wish they’d sell it.

It never does the things I want,

Just only what I tell it.

When talking about commerce we must talk about encoding money.

Currency

Money is a technology larger communities use to trade debts. The technology is becoming ever more open. Bitcoin’s essential innovation was a public blockchain, no need for a central bank. When I explain Bitcoin, I ask people to imagine it as a new virtual element. We know what the supply is. We know where most of it is. However, it is not money. It is a virtual element, but only a community can decide whether to use it to trade. A quick insanity check – the five year old Bitcoin has a market capitalisation of $8.5 billion today, about the same market cap as the two century old London Stock Exchange. There are now over 40 alternative cryptocurrencies, AltCoins. While Vint Cerf was talking intergalactic last year, Travelex announced Quids, Quasi Universal Intergalactic Denominations, a space currency. Bitcoin may fail, but some altcoins are likely to succeed and the technology has other applications, for example voting.

Wealth

Talking about money leads to dreams of wealth. Your Senior Warden Nic Birtles reminded me that the Master’s theme this year is Ubiquity, so I’ll remind you of the Silicon Valley definition of URL – “Ubiquity first, worry about Revenue Later”. In his essay “How To Get Rich”, the biogeographer Jared Diamond set out two principles for communities – connectivity and competition:

“First, the principle that really isolated groups are at a disadvantage, because most groups get most of their ideas and innovations from the outside. Second, [I also derive] the principle of intermediate fragmentation: you don’t want excessive unity and you don’t want excessive fragmentation; instead, you want your human society or business to be broken up into a number of groups which compete with each other but which also maintain relatively free communication with each other. [And those I see as the overall principles of how to organize a business and get rich.]’

So what is ‘open commerce’? Sharing data, especially public data, and keeping our communities sensibly competitive. Frankly, pretty much what Adam Smith wrote in The Wealth of Nations in 1776.

Gresham’s Law Of Commerce?

Sir Thomas Gresham’s family grasshopper graces his 16th century works, Gresham College, the Royal Exchange and St Martin’s goldsmiths. Gresham’s Royal Exchange was a market and shopping mall where you could trade the virtual, such as a share of a voyage. St Martin’s issued gold certificates you could trade if you believed in them. Gresham College is a Tudor Open University, online today also as a Tudor TED, and with a Creative Commons policy. But Gresham’s Law, “bad money drives out good”, was not his; it dates back to Aristophanes. More importantly, the law is expressed backwards. If you offer me a debased coin or a real coin, I’ll take the real coin unless some monarch insists we use his or her debased currency. The Nobel economist Robert Mundell rephrased Gresham’s Law properly as “cheap money drives out dear money only if they must be exchanged for the same price”. Open drives out closed.

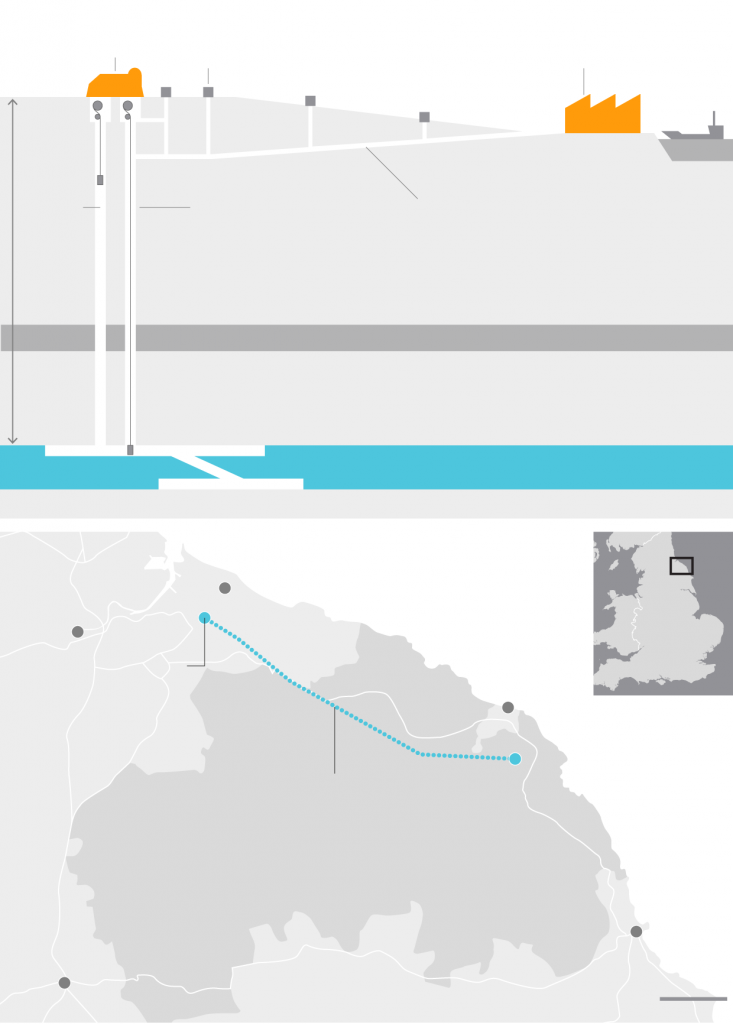

So do open data and competition drive out closed commerce? Start with open data. In the 1960s and 1970s the UK founded computer-based mapping. From 1979 to 1987, a number of us in the mapping industry tried to influence three Chorley reports to release publicly-owned ordnance survey and hydrographic data at cost. We failed. The industry moved to nations, principally the USA, Germany, and Sweden, where firms and researchers could get data at cost. Contrariwise, just a few years ago Transport for London decided on free release of train and bus data. A number of innovative London firms turned it into information on the smart phones you have in your pockets – hopefully switched off – today. Freeing data made London a global centre for software development of public transport apps.

In January the Rt Hon Lord Mayor Fiona Woolf CBE pointed out in her Tomorrow’s Cities Gresham lecture that our new city walls might be shared data walls – “Perhaps on entry to a city we contract to provide movement information from our smart phones to help transport planning – a mobile app passport. If I build a block of flats, I must provide ways of sharing energy, occupancy, or waste information with the city, which it anonymises, stores, and then shares more widely. I can link up with neighbours to consider new power or water treatment plants because I have the data on local consumers, their needs, their usage patterns.”

Competition

Master Michael Webster remarked via email last year on the benefits of Airbus and Boeing competition. In the 1970’s, just as it looked as if Boeing would have a monopoly on large passenger aircraft, the European community, at great expense, created Airbus. Though Europe has only come out even, thanks to the British and the French governments Boeing has no monopoly and benefits have spilled across the world through more diversity and lower prices.

How often does the average Briton meet a market? After government takes 40% of the average Briton’s income, the remaining 60%’s big ticket items are housing, fuel, and food. Six banks control mortgage markets; six energy providers dominate fuel: two in your area; four supermarkets dominate food: two in your area. We have a lot of monopolies and oligopolies. Few outside Brussels compare five dominant UK banks with the two thousand banks in Germany, or question four global auditing firms and three credit rating agencies. In IT for twenty years we quite rightly we worried about platform providers such as IBM, Intel, or Microsoft; now we worry about Google or Amazon. Competition is the most basic form of regulation. It keeps us on our toes asking questions, and it’s ruthless. When I asked my then 13 year old daughter why she hacked her school Microsoft computer to install Chrome, she heartlessly said, “Daddy, the only good use for Bing is finding Google”. At the Ministry of Defence I constantly asked my research teams “if you learned so much last year, why are you spending your budget the same way?”, and “I don’t care if it’s the best British technology, is it the world’s best?”.

We should worry about change. But we might equally worry about lack of change. What might e-retailing do to our high streets? We had more profound changes to our high streets over the past century due to the motor car. Yes, we should worry about privacy, liberty, security, and fair recompense. We certainly need to worry about earning our global crust as a competitive nation, but that’s brainpower as much as ownership. Pierre-Marc-Gaston in 1808 observed that « Il est encore plus facile de juger de l’esprit d’un homme par ses questions que par ses réponses. » “It is easier to judge the mind of a man by his questions rather than his answers”. Today Kevin Kelly of Wired observes that in “The world that Google is constructing – a world of cheap and free answers – having answers is not going to be very significant or important. Having a really great question will be where all the value is.”

Open The Competition

So what might you do? As good professionals you should be annoying about open data and competition. Open data is not just for governments. Have you thought about freeing data from your firm? Anonymise your vehicle movements and share with a traffic laboratory. Release some energy data in a challenge for students to help you become more renewable. Eliminate your legalese. The IT industry has a tortured relationship with copyright, patents, and contracts. I have a little numbers game I call ‘contract word count’ where I cut and paste those little online licenses that accompany every new app into a word processor. Then I do a word count. 100,000 words is a typical length for a novel. A typical Apple contract has over 40,000 words. My record find was an app with 90,000 words. For any lawyers here today, I wouldn’t lie. Yes, I sit in front of my screen reading for two hours before I click ‘accept’. Don’t you? My next target is to beat War & Peace’s 587,000 words. But have you thought about shareware, creative commons, and other methods of releasing information and sharing knowledge without such legal lunacies? And will you push for open competition, even when you’re in a position of strength?

Commonwealth is a 15th century term meaning “public welfare; general good or advantage”. “The common-wealth” or “the common weal” comes from an old meaning of wealth as “well-being” thus “common well-being.” The Lord Mayor believes our common weal is moving into our data. Our commons need to be places of competition not monopoly or oligopoly. A village green of fair sport, not village bullies. As liverymen, we start with community & comradeship, which leads to commerce, and after we’ve generated some wealth we turn to charity, building a just society. Perhaps we should call out volunteer Deputy Master Michael Grant in all his polished Pikemen and Musketeers finery to defend our commons? Our wealth is founded on what we share, which starts with data, then information, then knowledge, and then, perhaps, even wisdom. So, paraphrasing Vint Cerf, per aperta data et commercia ad astra – through open data and commerce to the stars.

Thank you.

May I ask all of you to be upstanding and drink a toast with me to the health of the Company. To the Company, may I.T. flourish root & branch!

Alderman Professor Michael Mainelli FCCA FCSI FBCS

Michael co-founded Z/Yen, the City of London’s leading commercial think-tank, in 1994 to promote societal advance through better finance and technology. Educated at Harvard, Trinity College Dublin and the London School of Economics, where after his PhD he was also a visiting professor, Michael started his career in the USA as a research scientist in aerospace and computing, later becoming a partner and board member in a leading accountancy firm directing consulting worldwide, before a spell as Corporate Development Director of Europe’s largest R&D organisation in the UK Ministry of Defence, the Defence Evaluation and Research Agency. At Z/Yen, Michael is responsible for leading innovative projects and research, particularly for financial, technology, and government clients. In 2005 Michael founded the Long Finance movement asking “when would we know our financial system is working?”. One event had 350 finance professionals singing for monetary reform with Brian Eno at the Willis building. Michael is a Freeman of the City of London and the Watermen & Lighterman, and a Liveryman of the World Traders.