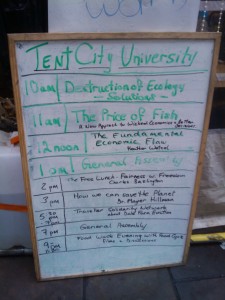

Watched Stephen Fry blend entertainment and reporting – “Key To The City” (of London) on ITVPlayer. Worked for me – https://www.itv.com/itvplayer/stephen-fry-s-key-to-the-city/series-1/episode-1-stephen-fry-s-key-to-the-city. Nice to see a lot of people I know doing their part and proud of the City and their work. While attitudes have come a long way from the depths of November 2011 (see Occupy’s Tent City University outside St Paul’s Cathedral photo below – and note The Price of Fish seminar), the City still needs more reforms. We need to earn respect, not demand it. This past week we’ve seen lows and highs, from probable scandals in the aluminium markets to Mansion House continuing to develop the City Values Forum. Long Finance respects the intentions of Occupy but believes that gradual, evolutionary reform from within is better than revolutionary reform from without. If you believe that too, get involved.

The City of London & Broad Street Ward

“Bright Lights, Open Minds, Robust Community”

A Brand New Auld Man

Today I had my first meeting before Common Council, where I had to make a few short remarks before the meeting began in earnest. For those who wish to know more about the City of London Corporation and the role of an Alderman or Broad Street Ward, there is plenty to surf.

The City of London Corporation is the world’s oldest continuously elected local government. The City is regarded as ‘incorporated by prescription’, meaning that the law presumes it to have been incorporated because it has for so long been regarded as such even in the absence of written documentation. The Corporation began in Anglo-Saxon times. The first record of a royal charter is 1067, when William the Conqueror confirmed the rights and privileges that the Citizens of London had enjoyed since the time of Edward the Confessor. Together, Common Council and the Court of Aldermen are considered to form the ‘grandmother of parliaments’. The governing legislation is the Magna Carta (1215), “THE City of London shall have all the old Liberties and Customs [which it hath been used to have]. Moreover We will and grant, that all other Cities, Boroughs, Towns, and the Barons of the Five Ports, and all other Ports, shall have all their Liberties and free Customs.”

End Of An Era & Start Of A New Age

Well, today was the swearing in ceremony at the Court of Aldermen. It was a warm and friendly event, and I was guided by many, but will single out our Deputy, John Bennett, who very kindly introduced me to the Court and soothed my nerves throughout. I set out the text of my response below:

My Lord Mayor, my fellow Aldermen. It is with some trepidation that I face this challenging role. I have much to learn, much more than I thought when I decided to stand for election in Broad Street a short while ago. Just over three decades ago I was a transient, happy, even ignorant immigrant to the City of London, here to do a job, not intending to stay permanently. Yet, I became entranced by the wonders of the City and discovered a community that treats all comers fairly and where “Dictum Meum Pactum” is not just a phrase from a dead language. Behind all the pomp and circumstance, I can attest that the true traditions of the City are those of Dick Whittington; an open and tolerant community of people where honest trade is respected and rewarded – or as Thomas Jefferson said at his inaugural speech which inspired my Worshipful Company of World Traders’ motto – “Commerce and honest friendship with all.”

I thank Sir David Lewis for leaving the Ward in such fine shape. I am honoured to have the support of three excellent Councilmen, including my friend and Deputy, John Bennett, John Scott and Christopher Hayward. I know that I have your support and look forward to learning from you and working with you in finding ways to increase the City’s attractiveness to businesses and residents. Regretfully, I shall probably make a few false steps along the way. May I petition in advance your understanding and guidance when I do so. May I thank you all for your encouragement and I look forward to serving with honour.

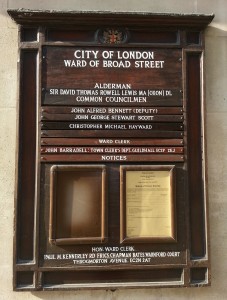

And I passed by St Margaret Lothbury where our parish church holds the Ward Notices to take a picture in honour of David, with the electoral result notice beneath:

I guess this is along the lines of “The Alderman has retired, long serve the new Alderman”.

Independence Day – All Tied Up By Broad Street Election Success

Yesterday was the Fourth of July, the traditional celebration day for American independence. While some sci-fi film buffs may think it has something to do with freedom from aliens, the day commemorates the adoption of the Declaration of Independence on 4 July 1776 – “When in the Course of human events,…”

Yesterday, Thursday, was also election day for Broad Street Ward Alderman. My opposing candidate and I spent 13 hours together, somewhat nervously, but passed the time in great conversation. Though an eavesdropper might have paraphrased Winston Churchill, “The best argument against democracy is a five-minute conversation with the average candidate.” In the end, the result was 62% to 38% in my favour. Alderman Ian Luder, acting as Lord Mayor locum tenens, kindly raised a glass of champagne, and I headed off to catch the digestif at the Gresham College annual dinner of the Professors.

So, what does the future hold? Well, formal installation begins next week and I hope to keep folks informed about City and Ward business, albeit perhaps slightly frequently than during the election. It is a great honour to be taking over from former Lord Mayor and Alderman Sir David Lewis, and to be working with three great Common Councilmen, John Bennett, John Scott and Chris Hayward. I genuinely look forward to your advice on how best to advance Broad Street Ward and the City.

All that said, I did wonder about independence. As this is a typical dress-down Friday and most of you know my aversion to neckties, it is a bit painful for me to realise that as Alderman I’ll be expected to wear ties far more often, let alone fancy dress of various forms, even silk stockings. To see how it should be done with style, here is David showing off his good looks…

Expect a slightly frumpier, balding and not-quite-so-slim-but-striving-hard-to-look-good, Alderman in future. Anyway, I’ll sign off by sharing this rather echoey quote from 1666 and Samuel Pepys, though it was 11 April and not 4 July – “Thence home, and after dinner to Gresham College, where a great deal of do and formality in choosing of the Council and Officers. I had three votes to be of the Council, who am but a stranger, nor expected any. So my Lord Bruncker being confirmed President I home, where I find to my great content my rails up upon my leads.”

Looking forward to greeting many of you at Guildhall in the future.

Wardmote Speech

Today’s Wardmote at Carpenters’ Hall was well attended and lasted 25 minutes. I hope to welcome any voters from 08:00 to 20:00 on Thursday, 4 July at Carpenters’ Hall.

I set out today’s speech and campaign pledge below:

After 29 years working in Broad Street Ward, it is with some humility that I stand before you today to ask for your vote for Alderman. I intend to say only a few words to avoid Soviet-era oratory. It was said that after one of his lengthy, repetitive speeches that Soviet leader Leonid Brezhnev confronted his speechwriter. “I asked for a 15 minute speech, but the one you gave me lasted an hour!” The speechwriter replied: “Comrade, it was 15 minutes, but I gave you four copies…”. You’ll be glad to hear I have a single copy.

You also have copies of my record and services to the City in print and media, so I thought I would touch on two things not in the record, my passion for the ward and what I hope to achieve if elected. My interest in Broad Street Ward dates back to 1984 when the Stock Exchange was still in the Ward and I began working on the computerisation of businesses here. Over the years I worked in various City firms from L Messel, the stockbrokers, to being one of the senior partners of Binder Hamlyn, the accountants, and back in the ward for a few years with Deutsche Morgan Grenfell before founding Z/Yen, widely recognised as the City of London’s leading think-tank and venture firm. In 2004, I became Chairman of the Broad Street Ward Club and increased the Club’s size markedly. I am passionate about this amazing heart of the City. I do not want to be AN Alderman, I would like to be THE Alderman of Broad Street Ward, and you are the people who will decide that.

What do I seek to do? Well, two things. First, from canvassing for this post I’ve learned that many businesses have closed or left the ward. Many electors have moved on or lost their jobs. We constantly need to find ways to increase the ward’s attractiveness to businesses and residents. There is a big desire among ward residents to explore ways of improving life in the ward. Imaginative thinking might do wonders with the pedestrian zone around Drapers Gardens, the opportunities of Crossrail, or the charm of Throgmorton Street. If elected, I would have six monthly informal meetings under the auspices of the Ward Club where businesses, residents and common councilmen can make strategic connections on these issues before planning begins. Toss ideas around once every six months over beer & peanuts or wine & olives.

Second, I want to work from within the City of London Corporation on improving the City’s attractiveness to business. We need to show that we are open to business and treat folks fairly in the City from wherever they hail, which has been my experience. London needs to continue to dominate my firm’s Global Financial Centres Index. This boils down to two tasks – providing local government that works for all, and lobbying central government for sensible policies that are friendly to any proper business.

Those are my two objectives – increase the ward’s attractiveness while ensuring that the City remains open for global business. They say that there is no difference between the Constitutions of the USA and Russia. Both guarantee freedom of speech. Perhaps, but the Constitution of the USA also guarantees freedom after the speech – and you’re now free of mine. But I do ask for your vote. Please vote for Michael Mainelli tomorrow. Thank you.

By Air, Land & Sea

The election campaign has been going great guns for almost three weeks. It’s a tough campaign and my fellow candidate has been meeting many of the electors as well. A wonderful group of friends have been fantastically supportive. I couldn’t begin to name them all but I can characterise the campaign so far as cyber, air, land & sea:

- cyber – these days it is trendy to talk about a fourth theatre as ‘cyber’, but we call it e-mailing. Rather than peppering people, there has been a single email to all (well, all we could have a guess at) followed by precision emails, frequently sent on our behalf to one, two or three electors;

- air – all postal voters were posted campaign flyers very early on, which really cuts into the tight budget that electoral law allows for the campaign;

- land – the hard work – has been done on two fronts, a mass hand-delivery by several kind volunteers and me, plus direct canvassing. John Bennett, John Scott and Chris Hayward have been exemplary at seeing their ward members. Friends have picked up some of the firms they work in. I’ve been helped in the direct door-to-door canvassing by many people, but I might pick out some of the bigger door-to-door visitors, Bob Reid, Mei Sim Lai, Ian Hillier-Brook, Mark Duff, Yvonne Duff, and my dear Elisabeth. Bob visited 30 electors face-to-face yesterday alone.

And some observations? Well, two things. The ward list is quite out-of-date, yet only 18 months old (qualifying date was 1 September 2012 and in force from 16 February 2013 to 15 February 2014). Many businesses have closed or left the ward. Many electors have moved on or lost their jobs. We constantly need to find ways to increase the ward’s attractiveness to businesses and residents. Second, there is a big desire among ward members to explore ways of improving life in the ward. More on this I hope at the wardmote. Please do come to Carpenters’ Hall at 12:00 on Wednesday, 3 July, if you’d like, but even more importantly make all this canvassing worth it by voting at Carpenters’ Hall from 08:00 to 20:00 on Thursday, 4 July. I hope to greet some of you there.

And sea? Well, sadly for a Thames barge owner like me, Broad Street Ward is landlocked. Happily though, I’m attending a luncheon today at the Watermen & Lightermen Hall down by the Thames where, though in Billingsgate Ward, I hope to meet a few more Broad Street electors.

Simply Messing About In Boats…

On Saturday, 29 June, the Chairman of the Broad Street Ward Club, our Common Councilman Chris Hayward, and the Secretary, Judith Rich, organised the most delightful day in Henley-on-Thames. Saturday was the day before the Regatta, so the town and the teams were polishing and practising everywhere. The day started with a whirlwind tour of the River & Rowing Museum. This architecturally stunning museum combines several themes – rowing, the Thames, local Henley history, and The Wind In The Willows. Then some of us took to the water for an hour to inspect the course. In a spirit of gamesmanship, we used a stinkpot rather than a scull to give the crews a fighting chance. Lunch is always a highlight of a Broad Street Ward Club day out, but in this case our Chairman used his connections as a member of the renowned Leander Rowing Club to have us dine above the river and amidst the pink hippos.

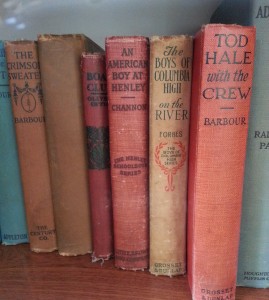

Following lunch we were permitted to view the Leander Club library where a delightful surprise emerged. The library had been founded with a donation of 1,750 books from Tom Hoffman, also a Common Councilman and Gresham College Trustee. I’d never known… And I had to take this picture of An American Boy At Henley.

Tickets to the museum are good for a year, so we returned after lunch for a second dose before catching the train home. As Rat (Kenneth Grahame) solemnly observed, “there is NOTHING — absolute nothing — half so much worth doing as simply messing about in boats.”

Why Broad Street?

A number of people have asked about Broad Street Ward and what’s interesting about it. I’ve started a page from which people can take links to various items – http://www.mainelli.org/?page_id=235

You probably have suggestions. All welcome!

Election of Sheriffs

I attended the annual election of two Sheriffs for the City of London today. Alderman Sir Paul Judge (Ward of Tower) and Robert Adrian Waddingham CBE were elected by acclamation.

The new Sheriffs will be admitted into office on Friday 27 September ready to preside at the Election of the Lord Mayor on Monday 30 September. They will hold the position for one year.

The office of Sheriff, a pre-requisite to becoming Lord Mayor, is one of the oldest in existence and dates back to the Middle Ages. Their duties today include attending the Lord Mayor in carrying out his official duties, attending the sessions at the Central Criminal Court in the Old Bailey and presenting petitions from the City to Parliament at the Bar at the House of Commons.

If only it were so easy in Broad Street Ward (sigh), but a great ceremony at the Guildhall.

Last Post

No, probably not the last blog note, just pointing out that yesterday, Wednesday 19 June, was the last opportunity for a postal vote application. Voters are now committed either to come in person or a postal ballot. On our side, we managed to get everyone in the ward either by post or hand (mostly hand!) a flyer and a postal application form by yesterday afternoon.

Meanwhile, it was also the last post for me at 22:20 last night. I was presenting, with Dr Iain Saville, the Systems in the City Awards 2013. Iain was on first and got the individual awards out of the way. Then a ventriloquist came up – Nina Conti. She’s possibly the funniest ventriloquist I’ve ever seen (and I’ve actually seen a few, including one last year in Germany the family booked). Her act featured a mind-bending routine with a monkey. Then, when the audience was well ready (ahem), up I pop for the corporate awards. Was I the organ grinder? While I may have drastically shortened my speech about yesterday’s Parliamentary Banking Commission on Banking Standards report, “Changing Banking for Good“, and Long Finance, the audience strangely didn’t seem to notice the cuts. A good time was had by all, and there are some very proud winners this morning.