Remarks to:

Livery Education Conference – Preparing Young People For The Future

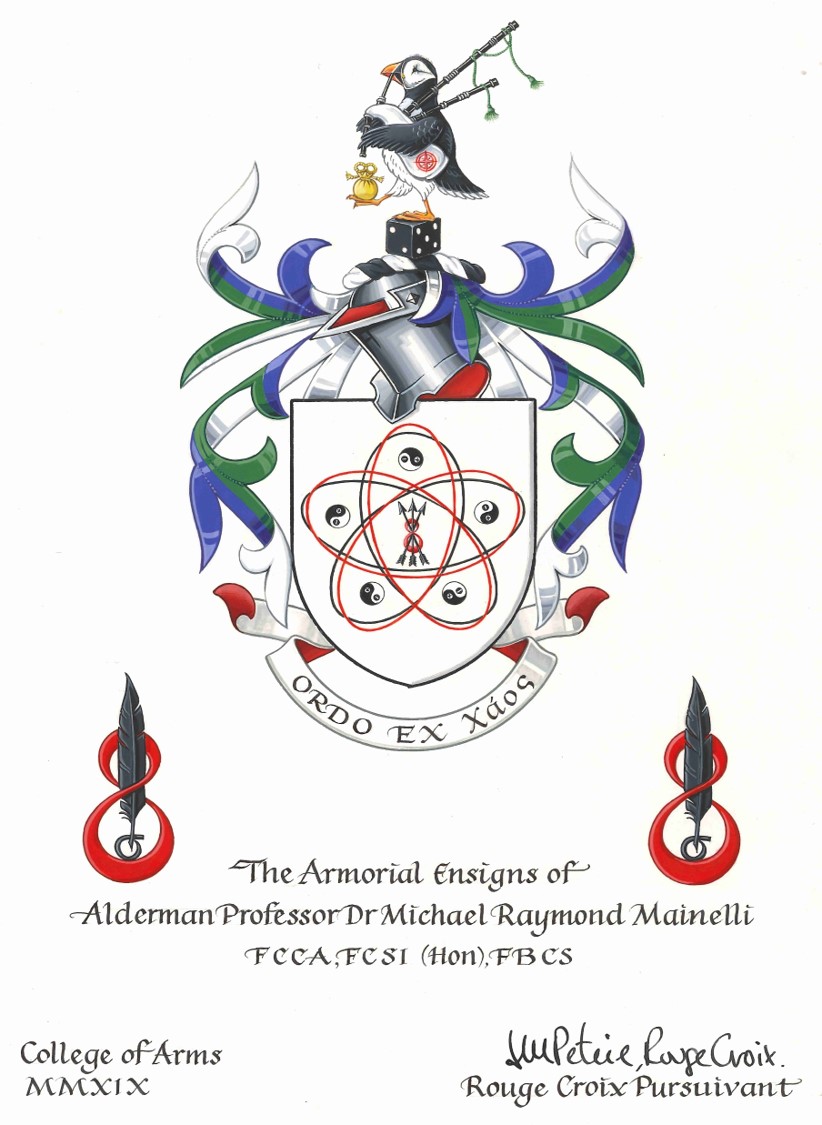

Alderman & Sheriff Professor Michael Mainelli MStJ FCCA FCSI(Hon) FBCS, Tuesday, 3 March 2020, Merchant Taylors’ Hall, London

“The Frontiers Of Education – Some Musings”

Masters, Wardens, Headteachers, ladies and gentlemen:

I have been asked to talk about education of the future, so I’ll start from the past. Exodus 2:22, King James’s Version, says: “And she bare him [Moses] a son, and he called his name Gershom: for he said, ‘I have been a stranger in a strange land’.”

Continue reading